Which of the Following Best Describes a Monte Carlo Simulation

Theory of Monte Carlo Simulation. OCW is open and available to the world and is a permanent MIT activity.

Monte Carlo Simulation Using Microsoft Excel To Estimate The Probability Of Passing Usp Dissolution Test Ivt

What is considered the first step in formulating a security policy.

. A Monte Carlo simulation is a model used to predict the probability of different outcomes when the intervention of random variables is present. It typically involves a three-step process. The Monte Carlo Simulation technique traditionally appeard as option choices in PMP exam.

The main ideas behind the Monte Carlo simulation are the repeated random sampling of inputs of the random variable and the aggregation of the results. It plays a crucial role in analyzing risks and solving probabilistic problems allowing businesses investors scientists and engineers to predict the range of results expected out of an uncertain situation. It is a tool for building.

By Monte Carlo simulation in trading you get a better understanding of the risk and uncertainty of your trading strategy because Monte Carlo simulation lets you run your backtest thousands of times in different orders. The Monte Carlo Simulation is a quantitative risk analysis technique which is used to understand the impact of risk and uncertainty in project management. This method is applied to risk quantitative analysis and decision making problems.

However over the past year we have noticed an increase in the use of this technique and there has been an increase in the questions that refer to the Monte Carlo simulation technique. Refers to any method that randomly generates trials but does not tell us. The simulations can make a model of the different outcomes of your trades if they had taken a different path or sequence.

The company want to choose the batch size that will maximise their profits. The simulations help to describe and assess the expected risk impact to eliminate uncertainity for better decisions. There are many PMP questions which directly refer to the properties.

A Monte Carlo simulation allows an analyst to determine the size of the portfolio a client would need at retirement to support their desired. The variable with a probabilistic nature is assigned a random value. 1 Which of the following best defines Monte Carlo simulation.

By Data Science Team 2 years ago. Which of the following best describes a Monte Carlo simulation. The Monte Carlo Method was invented by John von Neumann and Stanislaw Ulam during World War II to improve decision making under uncertain conditions.

Which of the following best defines Monte Carlo simulation. Run a simulation for each of the N inputs. B It is a collection of techniques that seeks to group or segment a collection of objects into subsets.

Randomly generate N inputs sometimes called scenarios. Monte Carlo Simulation also known as the Monte Carlo Method or a multiple probability simulation is a mathematical technique which is used to estimate the possible outcomes of an uncertain event. A It is a tool for building statistical models that characterize relationships among a dependent variable and one or more independent variables.

Depending on the number of possibilities the Monte Carlo simulation produces varied results that can be calculated over and over using different values at random. The model is then calculated based on the random value. Monte Carlo simulation is a computerized mathematical technique to generate random sample data based on some known distribution for numerical experiments.

Simulations are run on a computerized model of the system being analyzed. It is done by substituting a variety of values in any scenario that involves a level of uncertainty. The Monte Carlo simulation involves creating models with various values to determine risk analysis.

In order to help them make the right decision they have asked you to perform a Monte Carlo simulation analysis of the expected profits. Monte Carlo simulations help to explain the impact. Only one uncertain decision can be in any simulation model C.

Each of the above is true ANSWER A. The simulated probability distribution will be the same as the actual probability distribution B. They have provided you with the following information.

Draw the square over 1 1. It is used to model the probability of various outcomes in a project or process that cannot easily be estimated because of the intervention of random variables. Monte Carlo simulation ensures that.

MIT OpenCourseWare is a web-based publication of virtually all MIT course content. The technique is used by professionals in such widely disparate fields as finance project management energy manufacturing engineering research and development insurance oil gas transportation and the environment. Probabilities must be at most two decimal places D.

Different iterations or simulations are run for generating paths and the outcome is arrived at by using. The result of the model is recorded and the process is repeated. The following Monte Carlo approach can be used to approximate the value of π.

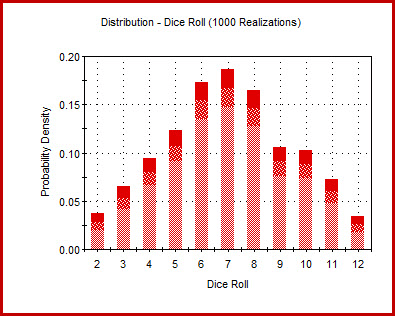

Monte Carlo simulation is a shape calculator that generates probability distribution shape of system output performance metrics based on probability distribution of system inputs. Monte Carlo Simulation is a mathematical technique that generates random variables for modelling risk or uncertainty of a certain system. Monte Carlo Simulation.

The process of reviewing records of network computer activity is called which of the following. Monte Carlo or Multiple Probability Simulation is a statistical method for determining the likelihood of multiple possible outcomes based on repeated random sampling. An analytical method that simulates a real-life system for risk analysis.

The random variables or inputs are modelled on the basis of probability distributions such as normal log normal etc. You can use the Monte Carlo Simulation to generate random variables with the help of a mathematical technique. You can use this technique to determine uncertainty and modeling the risk of a system.

This method is used by the professionals of various profiles such as finance project management energy manufacturing engineering. It is known that there will be fixed production costs of 10000. Monte Carlo simulation is a computerized mathematical technique that allows people to account for risk in quantitative analysis and decision making.

Monte Carlo simulation is a technique used to study how a model responds to randomly generated inputs. Consider a best-fitting circle that can be slotted into a square with a range of ℝ2 over. You use random inputs and variables according to the simple probability.

Monte Carlo Simulation An Overview Sciencedirect Topics

Monte Carlo Simulation Overview Vortarus Technologies Llc

No comments for "Which of the Following Best Describes a Monte Carlo Simulation"

Post a Comment